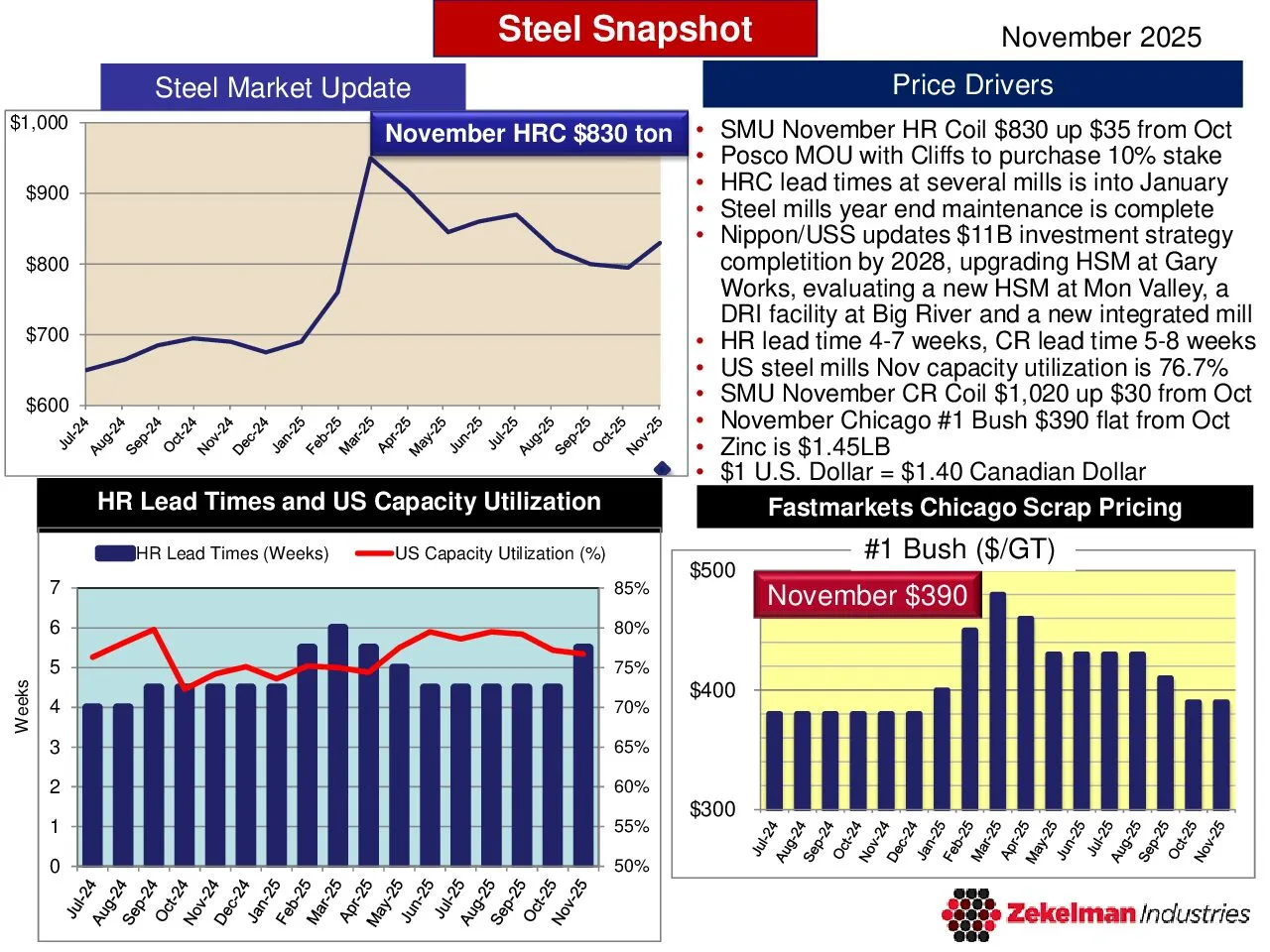

Tariff Schedule

Announced February 4, 2025 – 25% tariffs on goods from Mexico and Canada, as well as 10% tariffs on imports from China, but the next day announced a one-month pause on Canada and Mexico after reaching agreements with each country. Continued with the planned 10% tariffs on goods from China.

Announced March 4, 2025 – Previously announced tariffs went into effect with Canada, Mexico and China, but the Canada and Mexico ones were again paused.

Effective March 12, 2025 – 25% on all imported steel, including from countries previously exempt (Canada, Mexico, EU, Japan, etc.)

Effective April 2, 2025 – 10% on all imports, with higher “reciprocal” tariffs for specific countries

Effective April 9, 2025 – Higher tariffs were implemented, including a 125% tariff on Chinese imports, and a 20% tariff on European Union goods.

Effective April 9, 2025 – 90-Day pause on “reciprocal tariffs” for most countries, reverting their rates to the baseline of 10%. However, the 25% tariffs on steel and aluminum remained in effect.

Effective May 12, 2025 – US and China have agreed to a 90-Day pause on most tariffs that they have imposed on each other since last month, taking a big step toward easing the trade war between the two countries.

With the U.S. reducing tariffs on Chinese exports to 30%, a surge in new orders has followed, which has the potential to push near-term global demand and freight activity higher, potentially increasing freight costs.

Effective June 4, 2025 – White House announced an additional 25% (for a total of 50%) on all imported steel and aluminum.

Effective August 1, 2025 – White House announced a 50% tariff on import copper.